Ready to take the next step in learning how to build a bank for the future? We understand you might have a few questions and would love to answer them for you. You have our 100% commitment.

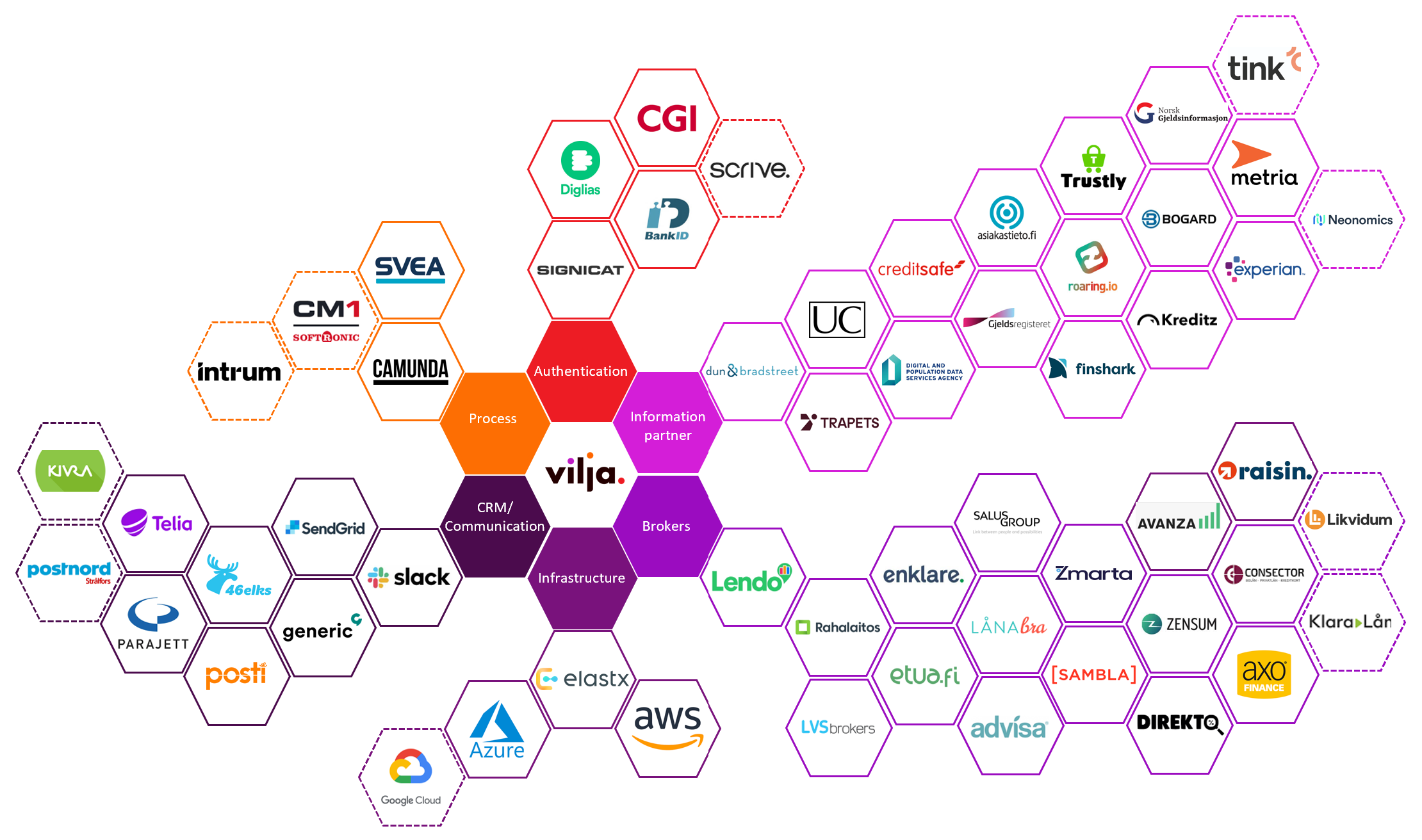

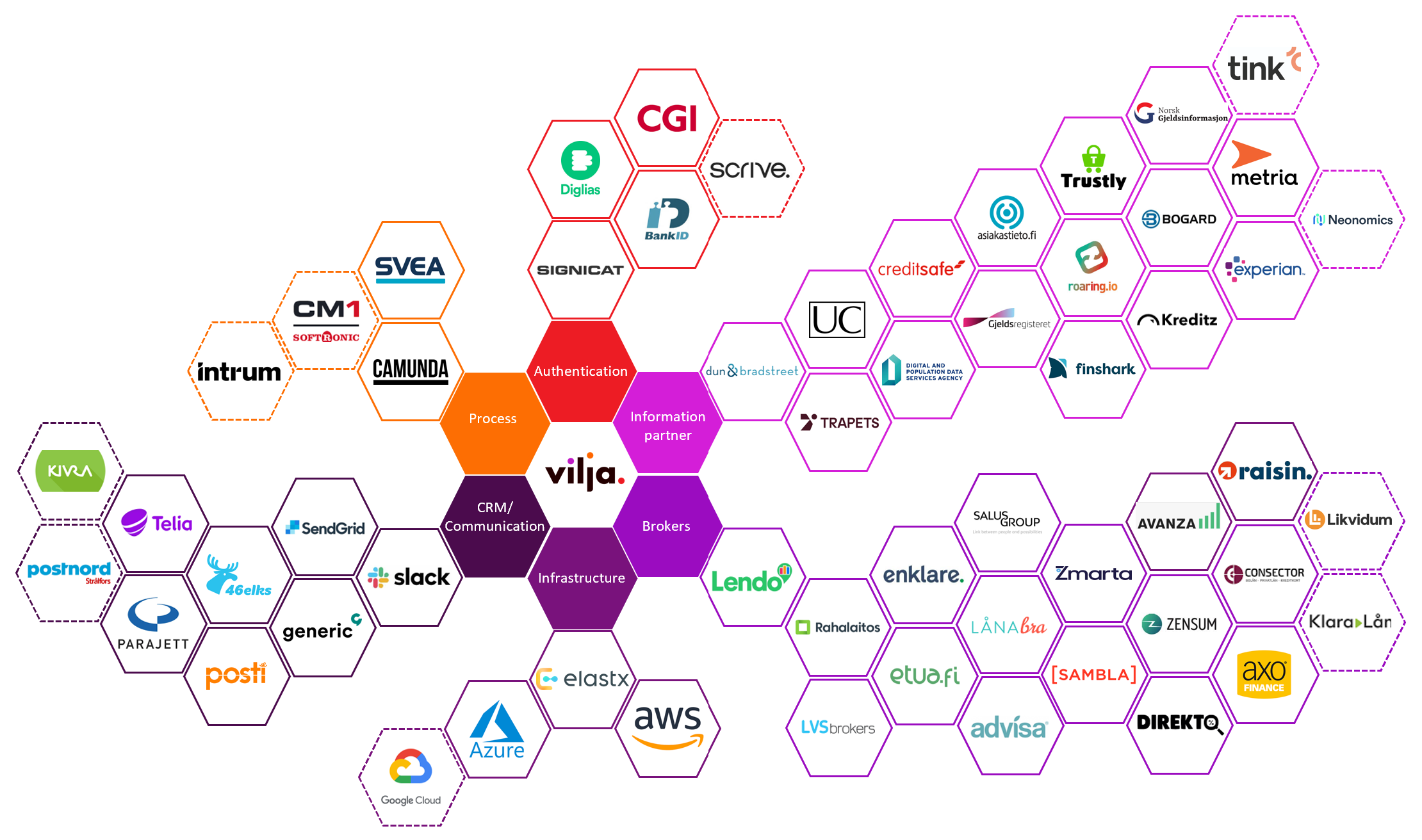

To keep our promise of delivering the best core banking platform, we need to work with the best partners in the industry. With consumable API’s, our platform is built for collaboration and easy integrations.

We are committed to investing in, and growing, our partner ecosystem. All to offer you unbeaten expertise and advice. So that you can focus on creating innovative and value-adding solutions to your customers.

Below is a selection of our current partner landscape with ready integrations for smooth ramp-up and low establishment costs. Our partner family is growing every day. If you’re interested in joining our community, please give us a ping.

Vilja Platform is cloud-agnostic and allows you to choose between hosting your operations in a global public cloud like Microsoft Azure or in a local public cloud like our Swedish provider Elastx. It depends on your preferences and requirements.

Independently of which cloud you choose, we guarantee security, reliability, and scalability. We cater to your specific business, technical, and regulatory needs within the same geographic region without compromising availability or service levels.

As we only use the latest proven technology, our solutions run on Kubernetes and are built for high availability and are designed to always be accessible. Kubernetes is a portable, extensible, open-source platform for managing containerized services. Read more on how we ensure you stay secure and compliant.

Ready to take the next step in learning how to build a bank for the future? We understand you might have a few questions and would love to answer them for you. You have our 100% commitment.

• Superior customer experience: Modern “My Pages” built for self-service and automation

• User friendly and extensive back-office: Designed for easy product management, smooth servicing and rich compliance functionality

• Complete end-to-end solution with modular approach: Cover the full customer life cycle, KYC & servicing, both at onboarding and recurring

• Self-service payments: register bill payments and transfers and have them executed on the payment rails of your choice

• Timely and accurate: Scheduled as well as ad-hoc payments, with support for basket signing

• Open Banking: TPP-enabled and supported by complete APIs and webhooks, protected by Strong Customer Authentication

• Superior experience: Personalized loans crafted to match both lenders and end-customers’ needs. Support for large volume customer loans to complicated SME loans with complex repayment schemas.

• Secured lending: Reduce risk by utilizing the built-in collateral service to define different collaterals and link them to the various types loans

• Efficiency and speed: High degree of automation and self-service enable lenders to scale their business with less staff. And streamlined application process for faster approvals.

• Launch products: Utilized our feature rich lending engine to quickly react to market changes and deploy new products

• Tailored for growth: Customizable leasing product to fit your business needs.

• Seamless integrations: Integrate with third-party data providers or internal systems for smooth operations automation.

• Customize journeys: Custom-built workflows allow for smooth journeys for both system administrator and end-customer.

• Tailored to your unique needs: Our service offer a highly customizable journey through the loan origination process, equipped with cutting-edge digital documentation support and a flexible collateral model.

• Elevate your mortgage servicing: High degree of automated processes like invoicing and payment allocation as well as self-service APIs enables you to concentrate on what truly matters in your business.

• Expertise in managing complex loans: This forms the foundation of our flexible, yet robust, mortgage platform.

• Flexible credits: Allow customers to withdrawal money according to their needs

• Campaign support: Enable campaigns to create flexible repayments schemes or increased lending

• Set limits: Allow customer to define spending limits for responsible lending and increased customer control

• Highly customizable: define your own templates, fields, notification and workflows to create tailored customer journeys with high degree of customer self-service

• Seamless end-to-end service: Streamlines the entire process from application to collection, enhancing customer experiences and operational efficiency.

• Stimulate new sales: Quickly launch and manage multiple products with time-limited offers, ensuring your retail strategies stay dynamic and responsive.

• Simplifies complex logistics-related financial tasks: Sophisticated merchant management system including handling returns, delayed shipping and daily partner reconciliation.