Handle everything from high-volume SME lending to complex property financing with flexible products. Reduce risk with built-in collateral capabilities, and roll out new offerings quickly as the market changes.

Deliver personalized consumer loans that meet both lender and customer needs. Offer loans in multiple channels with built-in broker support, and launch new products fast with a feature-rich lending engine.

Offer flexible leasing products tailored to customer needs, with seamless integrations that increase automation. Use custom workflows to create smooth journeys for both administrators and end customers.

Create self-serve revolving credit journeys with customizable templates, fields, and workflows. Let customers set spending limits, and run campaigns for flexible repayments or increased lending.

Tailor mortgage origination with digital documentation and a flexible collateral model. Automate servicing with invoicing, payment allocation, and self-service APIs.

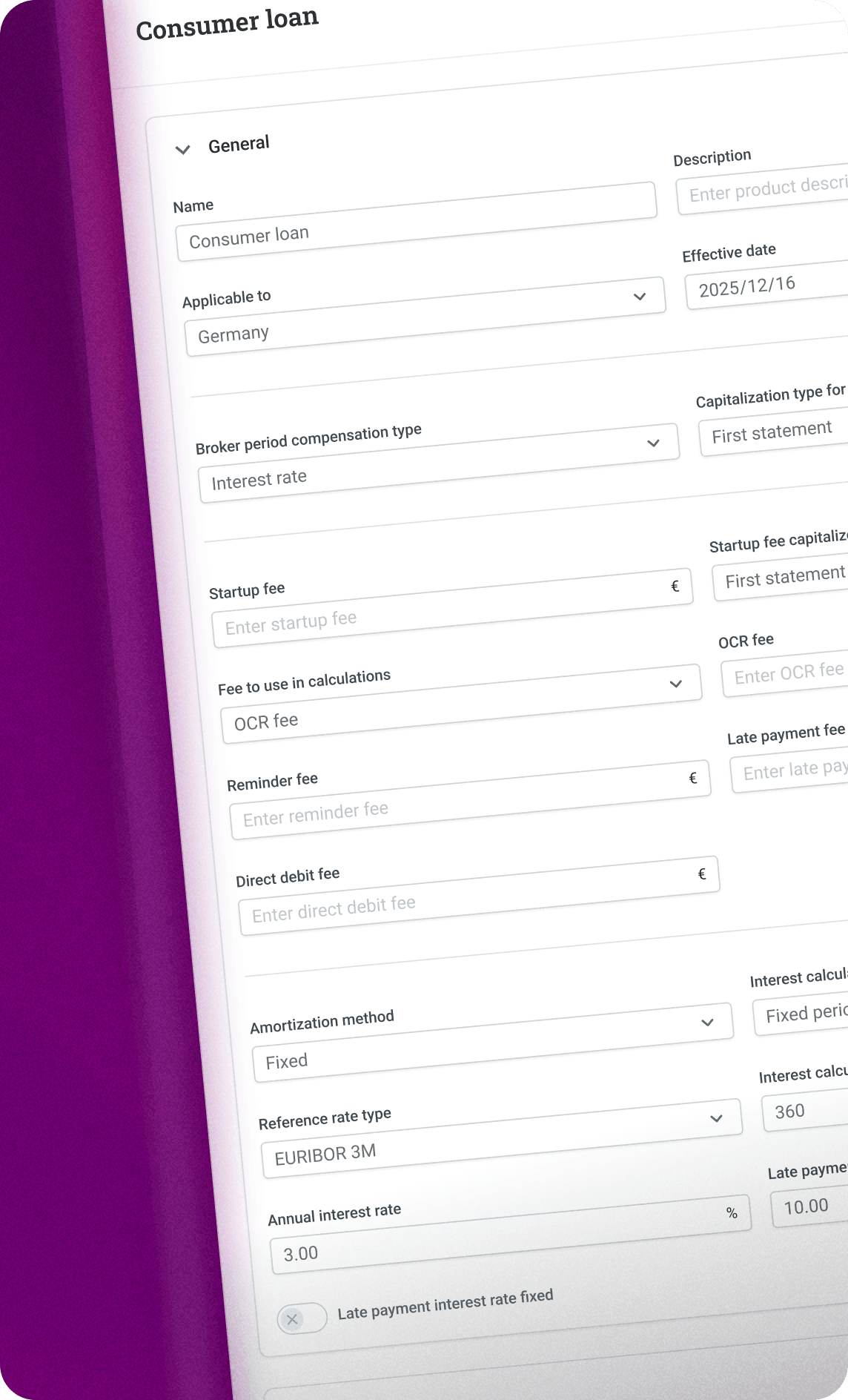

Vilja CoreComposer™ let you design lending products that match your exact business model. Configure interest rates, repayment terms, and product structures with complete freedom. Build sophisticated lending catalogs where products work together: combine main offerings with supporting products and offers, or design standalone solutions. Whether you need a simple or complex structure, the flexibility is there to support your unique lending catalog — exactly as you want it.

The platform's composable architecture means you're not limited to pre-defined templates. Whether you need standard consumer loans or highly specialized financing products, configure exactly what your customers need without custom development or workarounds.

Cover the complete lending lifecycle with robust APIs and automation at its core. Connect your custom front-end or use the lending solution to bring customers in, then automatically score them against your defined parameters for fast, consistent decision-making.

Once approved, servicing runs itself. Handle invoicing, payment processing and interest calculations automatically. Communicate flexibly — via SMS, email, or secure messaging, and generate custom documents with your branding.

Lending doesn't happen in isolation. Connect seamlessly with the partners and systems that drive your business — from lending brokers to credit bureaus, communication platforms, and your existing banking infrastructure. Pre-built integrations mean you can start onboarding customers immediately without spending months on custom development.

Whether you're working with broker networks to expand your reach or integrating with third-party services for credit scoring and customer communication, the platform connects to your entire lending ecosystem out of the box. Focus on your lending strategy while we handle the technical complexity.

With years of experience and passion for making our customer succeed, we are proud of our customer relations.

Our cloud-native core banking platform is delivered as a fully managed SaaS solution and offers a wide range of prepackaged solutions – deposits (term deposits and overnight) and loans (SME loans, Consumer Loans, Revolving Credits, Mortgages).

Our composable design enables you to choose to cover the full customer lifecycle from Onboarding & KYC, Origination & Scoring to CRM & Servicing or start with one module and expand from there.

Yes, Vilja Platform is a cloud-native platform offering services on top of multiple cloud supplier infrastructures.

Vilja Platform features a Kubernetes-based microservice architecture, modular components, and an API-centric design that enables flexible deployment, integration, and automated workflows in the cloud.

Vilja Platform is a modern, cloud-native banking platform that offers a full end-to-end solution in a composable design.

Vilja takes full responsibility throughout every stage of the implementation to ensure a safe and secure go-live.

Vilja Platform is built for automation, self-service and configuration, making the overall TCO low.

Vilja has a record-high NPS (Net promoter Score) of 67.

Yes, Vilja Platform has existing integrations to a number of third-party financial services and an integration framework that allows you to extend it. ISO20022 messaging allows you to exchange payment information with payment providers and partners and the template-based framework allows great flexibility.

Vilja Platform is built on a microservices architecture (MSA) deployed on Kubernetes, enabling horizontal scaling on demand. Each service can scale independently based on load, ensuring optimal resource utilization and the ability to handle growing transaction volumes without disrupting other parts of the system.

This cloud-native approach allows the platform to seamlessly adapt to changing business needs, from startup volumes to enterprise-scale operations.

Yes, Vilja offer a full end-to-end solution from Onboarding & KYC, Origination & Scoring to CRM & Servicing. Our composable design enables you to choose the end-to-end approach or start with one module and expand from there.

Ready to take the next step in learning how to build a bank for the future? We understand you might have a few questions and would love to answer them for you. You have our 100% commitment.

• Superior customer experience: Modern “My Pages” built for self-service and automation

• User friendly and extensive back-office: Designed for easy product management, smooth servicing and rich compliance functionality

• Complete end-to-end solution with modular approach: Cover the full customer life cycle, KYC & servicing, both at onboarding and recurring