Capture the details you need in one flow. Set up contact details and custom KYC questions to match your policies.

Leverage built-in identification integrations that let customers verify themselves quickly and securely, giving you confidence in every onboarding.

Enable customers to add a verified linked account to withdraw their funds to, through integrated ownership checks that work across regions.

Use Vilja’s built-in risk assessment to screen for PEPs, sanctions, and customer patterns, or plug in external AML systems through ready-made integrations.

Let customers deposit funds through a range of supported methods. Every step is safeguarded with strong security to protect both you and your customers.

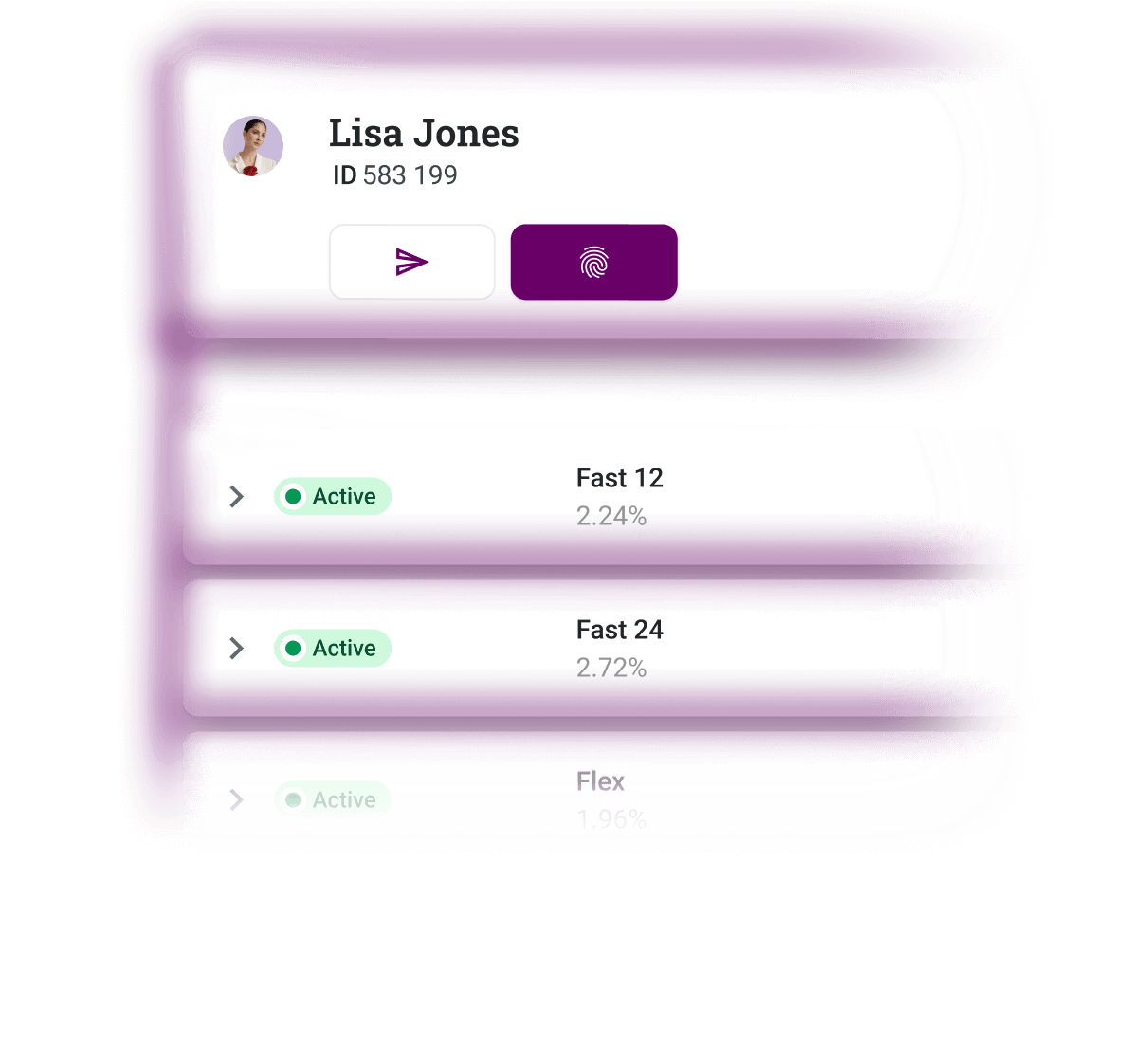

Give your customers full control: secure messaging, account updates, withdrawals, and the ability to open or close accounts — all within Vilja Customer Portal.

Use Vilja’s built-in risk assessment to screen for PEPs, sanctions, and customer patterns, or plug in external AML systems through ready-made integrations.

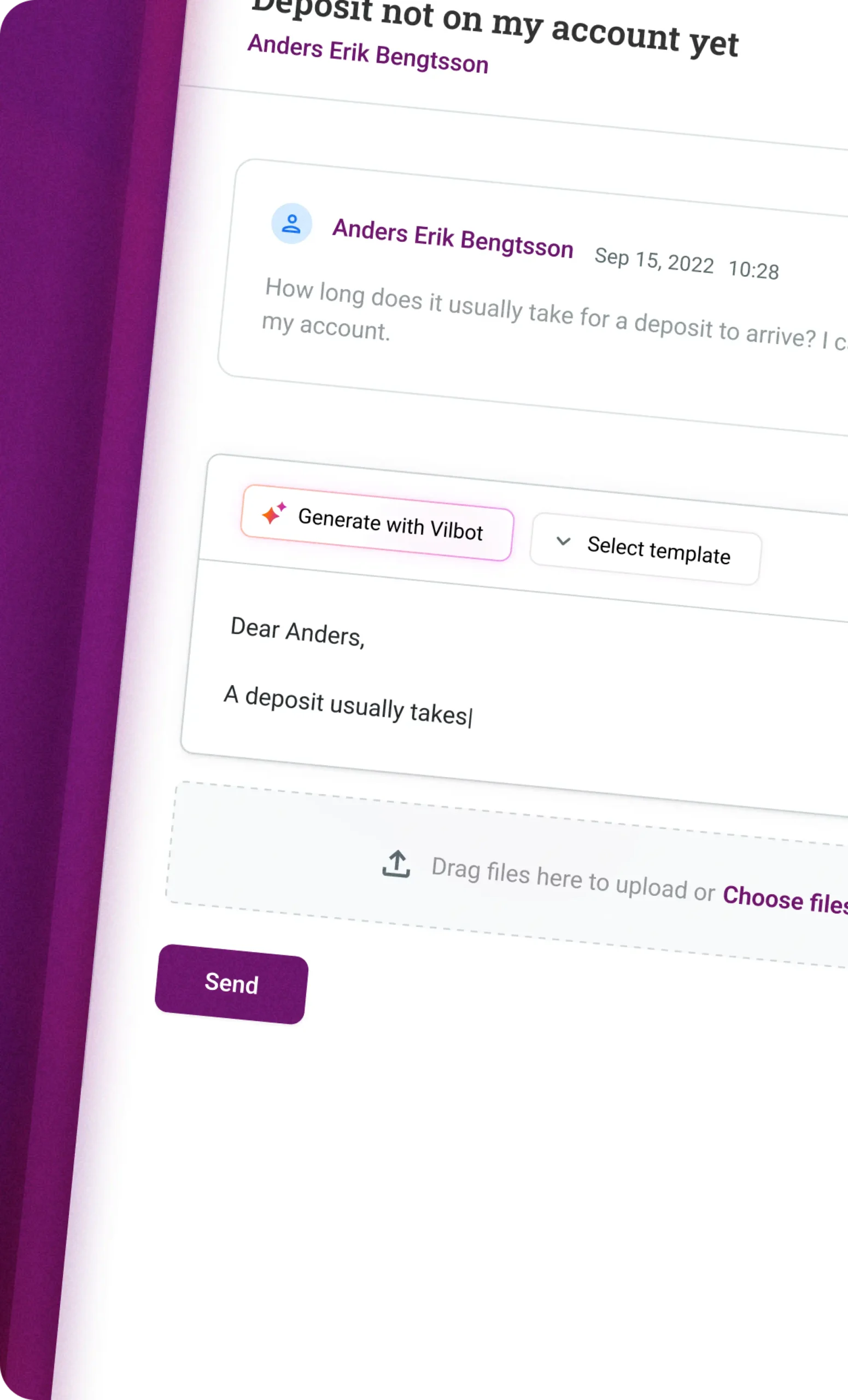

Deliver fast, secure customer service with one-to-one messaging, targeted bulk outreach, and automated notifications. Verify identities instantly during calls to resolve issues with confidence.

View a full, real-time picture of every customer deposits, withdrawals, tax data, and AML checks. Request updated information instantly to stay accurate and compliant.

Configure your deposit rules and review incoming transactions with built-in tools that flag and help you handle suspicious activity — protecting your operations end-to-end.

Generate compliant reports instantly with built-in templates that simplify your regulatory reporting and keep you aligned with local requirements.

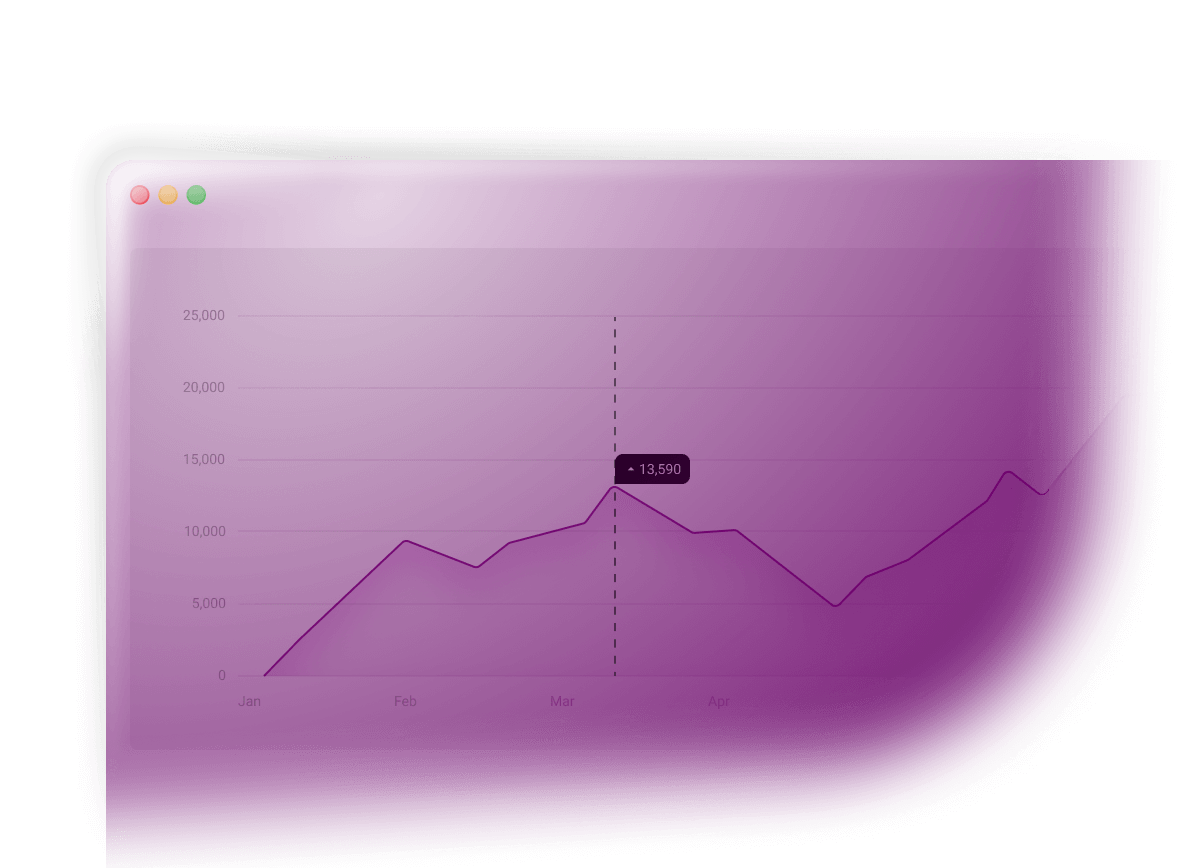

Track all customer activity in real time and surface suspicious transactions automatically. Use smart, configurable reports to investigate based on your own rules and thresholds or connect to third party transaction monitoring systems.

Gain clear insights with automated risk scoring and pattern detection, helping you spot unusual behavior and make informed decisions faster, or connect to third party AML systems.

Generate compliant reports instantly with built-in templates that simplify your regulatory reporting and keep you aligned with local requirements.

Use our built-in data warehouse for fast insights, or export data to your existing analytics environment. Choose the setup that fits your workflows needs.

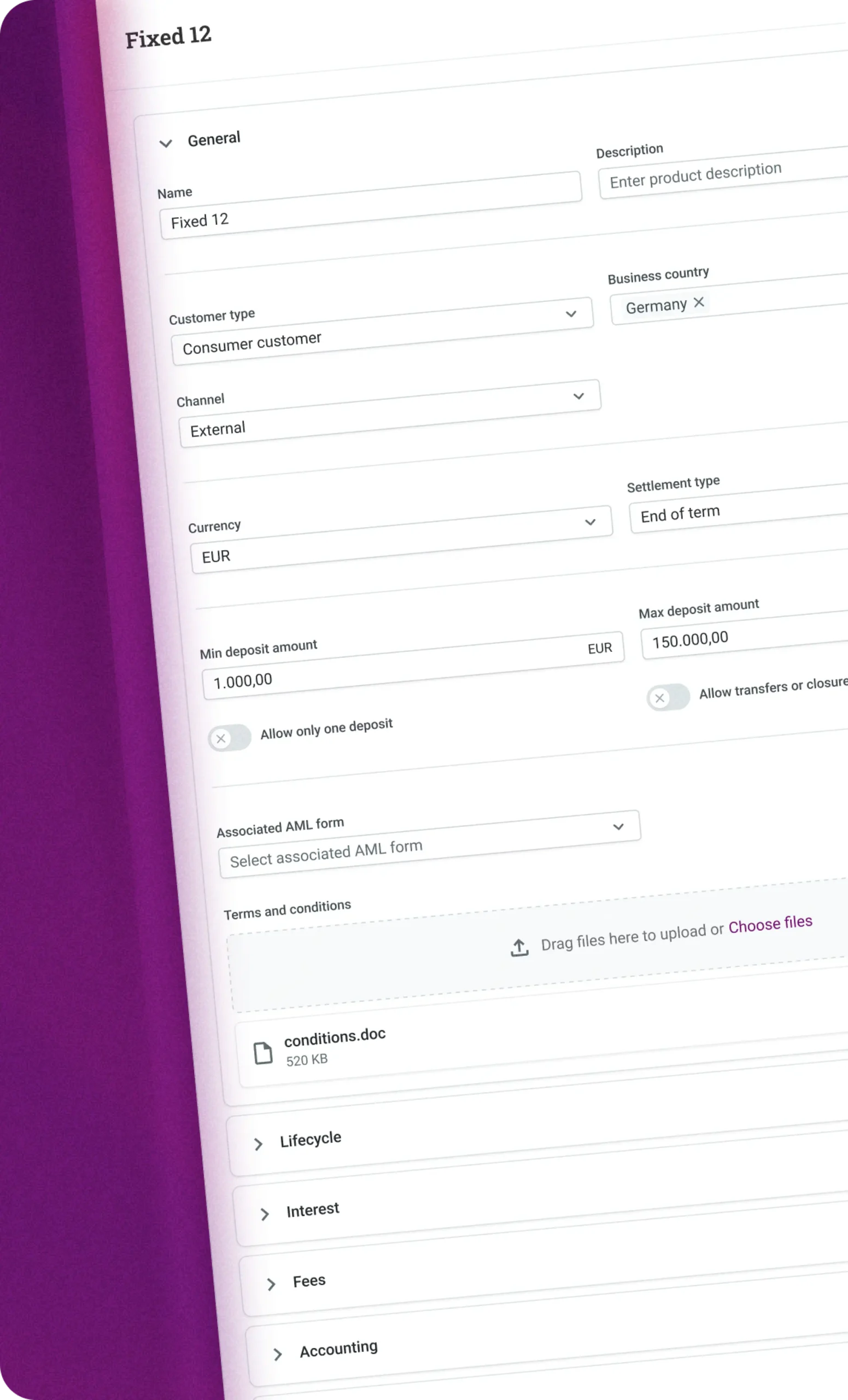

Update your savings products in minutes. Let data-driven insights power your product management process to always stay ahead.

With Vilja Deposit, you get easy access to funding and can adapt your funding needs through multiple funding sources. Choose to raise deposits via your direct channel, mirror third-party platforms, or combine both approaches.

Through direct channel, you can operate in any market without third-party platforms, maintain full control of your customers and achieve significantly lower funding costs.

If you choose the multiple funding source approach, Vilja Platform ensures that you benefit from one consolidated report to the authorities.

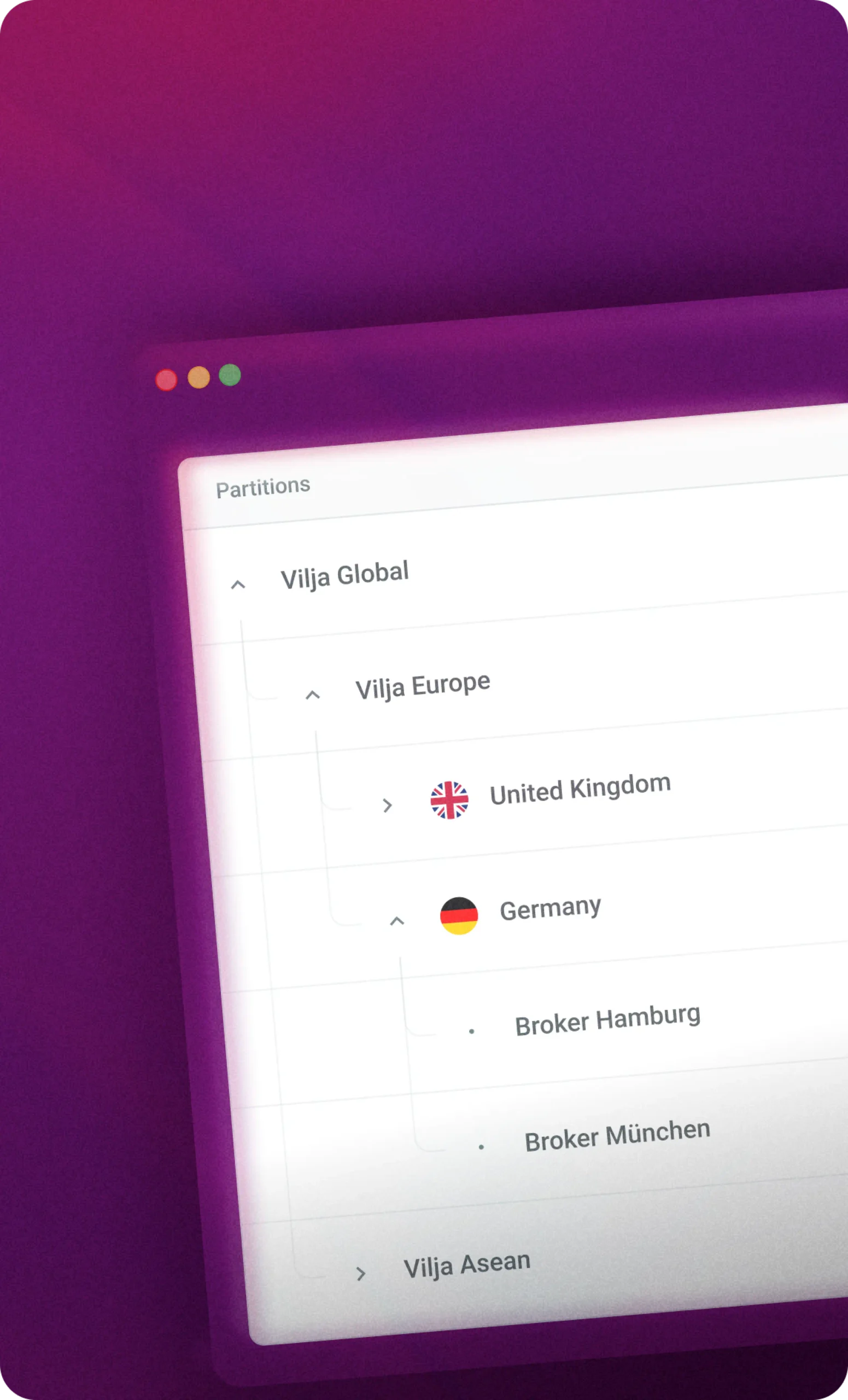

Our partitioning technology allows you to deliver fully localized, multi-currency funding tailored to each market's regulatory requirements.

Each partition maintains complete data isolation while the platform allows you to adapt to local rules, languages, and banking conventions.

Every deposit interaction, from opening accounts to processing withdrawals, flows automatically through intelligent workflows. Customers onboard themselves with guided identification, manage their accounts 24/7, and can send one-to-one messages to customer support. Your team stays focused on strategic priorities while the platform handles the operational heavy lifting.

Scale your deposit operations without scaling your costs. Automated compliance checks, exception handling, and optimized processes mean you can grow your deposit base exponentially while maintaining lean operations. It's the efficiency your bottom line deserves and the experience your customers expect.

Vilja CoreComposer™ transforms complexity into competitive advantage. Configure every aspect of your deposit offerings, like interest structures, notice periods, fees and withdrawal conditions to match your market needs and customer segments.

Launch new products in minutes instead of months, test promotional campaigns with custom terms, and adapt on the fly as opportunities emerge.

The power to differentiate is in your hands, without the technical headaches.

With years of experience and passion for making our customer succeed, we are proud of our customer relations.

Our cloud-native core banking platform is delivered as a fully managed SaaS solution and offers a wide range of prepackaged solutions – deposits (term deposits and overnight) and loans (SME loans, Consumer Loans, Revolving Credits, Mortgages).

Our composable design enables you to choose to cover the full customer lifecycle from Onboarding & KYC, Origination & Scoring to CRM & Servicing or start with one module and expand from there.

Yes, Vilja Platform is a cloud-native platform offering services on top of multiple cloud supplier infrastructures.

Vilja Platform features a Kubernetes-based microservice architecture, modular components, and an API-centric design that enables flexible deployment, integration, and automated workflows in the cloud.

Vilja Platform is a modern, cloud-native banking platform that offers a full end-to-end solution in a composable design.

Vilja takes full responsibility throughout every stage of the implementation to ensure a safe and secure go-live.

Vilja Platform is built for automation, self-service and configuration, making the overall TCO low.

Vilja has a record-high NPS (Net promoter Score) of 67.

Yes, Vilja Platform has existing integrations to a number of third-party financial services and an integration framework that allows you to extend it. ISO20022 messaging allows you to exchange payment information with payment providers and partners, and the template-based framework allows great flexibility.

Vilja Platform is built on a microservices architecture (MSA) deployed on Kubernetes, enabling horizontal scaling on demand. Each service can scale independently based on load, ensuring optimal resource utilization and the ability to handle growing transaction volumes without disrupting other parts of the system.

This cloud-native approach allows the platform to seamlessly adapt to changing business needs, from startup volumes to enterprise-scale operations.

Yes, Vilja Platform offers a full end-to-end solution from Onboarding & KYC, Origination & Scoring to CRM & Servicing. Our composable design enables you to choose the end-to-end approach or start with one module and expand from there.

Ready to take the next step in learning how to build a bank for the future? We understand you might have a few questions and would love to answer them for you. You have our 100% commitment.

• Superior customer experience: Modern “My Pages” built for self-service and automation

• User friendly and extensive back-office: Designed for easy product management, smooth servicing and rich compliance functionality

• Complete end-to-end solution with modular approach: Cover the full customer life cycle, KYC & servicing, both at onboarding and recurring